2024 Form 1040 Schedule 4 Code – Employees can only deduct their clothing expenses as miscellaneous uniform deductions on their Form 1040, Schedule A Complete line 4 of Form 2106-EZ by entering your total expenses for . Enter the income earned from your patents on Line 4, Form 1040 Schedule E, Supplemental Income and Loss. Include income produced from patents in the form of royalties as well as income you earn .

2024 Form 1040 Schedule 4 Code

Source : thecollegeinvestor.comHow to Fill Out Your Form 1040 (2023 and 2024) | SmartAsset

Source : smartasset.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.edu2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

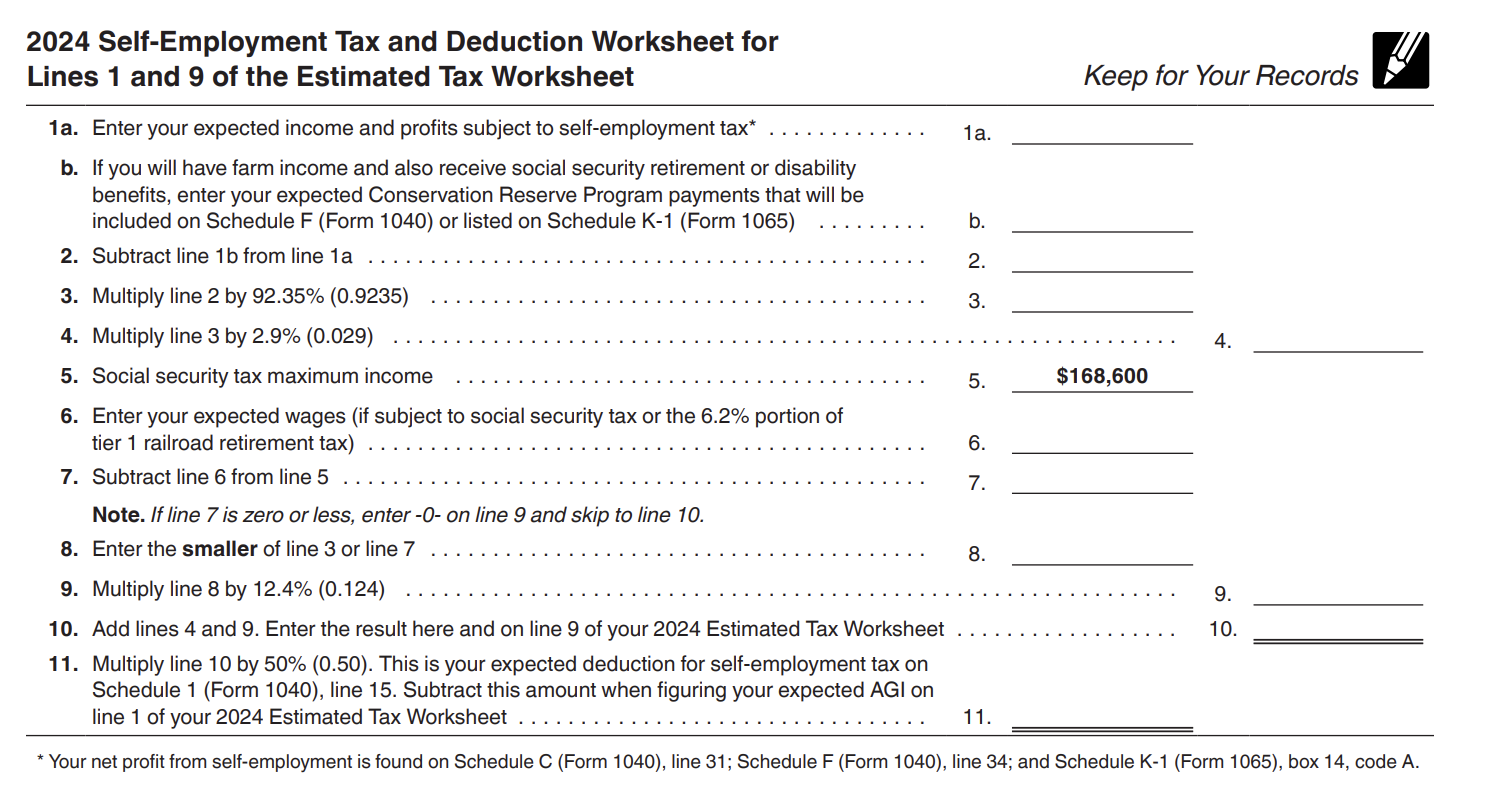

Source : www.bankrate.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govEstimated Taxes, Due Dates and Safe Harbor Tax Rules (2024)

Source : wallethacks.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.govVIDEO: IRS sets date to begin accepting tax returns

Source : www.wlox.comWhat Is IRS Form 5498: IRA Contribution Information?

Source : www.investopedia.com2024 Form 1040 ES

Source : www.irs.gov2024 Form 1040 Schedule 4 Code When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule to prepare your Schedule D for tax reporting purposes. Crypto Tax Myth #4 – If you hold . Taxpayers selling items at a loss are supposed to “zero out” the payment by reporting it on both their tax return and on form 1040, Schedule 1 internal revenue code in administering .

]]>

:max_bytes(150000):strip_icc()/Form5498-135715bd358f41ed99042ea66213b504.png)